Businesses across all industries have adopted new technologies to transform their processes and improve competitive advantage. One example of how technology can fundamentally change P&C insurance for commercial lines of business is with the adoption of ISO Electronic Rating Content (ISO ERC™).

To get the best results for your ISO Commercial Lines of Business; look for a solution with:

1: Electronic Consumption of the ISO Commercial Lines Data

Most insurer and vendor systems were not designed to electronically import ISO data, so the information in the ISO Commercial Lines Manuals and Circulars must be extracted and translated into code that the system can understand and use. This requires manual manipulation of the data which is expensive, time-consuming, and resource-intensive.

However, Solartis has cracked the code on electronically consuming ISO ERC™. This gives the Solartis Insure Platform game-changing advantages in enabling insurers to bring ISO-based products to market faster, with less cost and risk during development.

The Solartis digital rendition of the electronically-consumed ISO Commercial Lines Manuals and Circulars powers premium calculations, form selection rules, generates the user interface and provides the statistical codes. ISO filings and Circular updates are automatically incorporated into the Solartis product library and ready for selection and use.

2: Product Configuration and Maintenance Made Easy

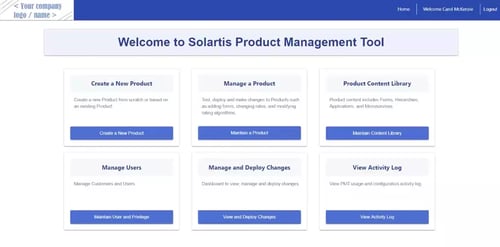

The Solartis Builder is a completely self-service tool that manages all aspects of your ISO Commercial lines of business; your states, plans, coverages, tables, user interface pages, and page attributes, policy documents (and their associated forms) as well as the rating algorithms and your processing rules.

The Solartis Builder is also where you add your carrier exceptions, deviations, and proprietary forms and documents. Use the Solartis Builder to test your ISO-based product content, and to promote it from DEV to TEST to LIVE mode in a single environment.

3: A Cloud-based API-Centric Rating and Policy Administration Platform

The Solartis Insure platform is a collection of policy life cycle services that are built from the ground up on microservice architecture. Use all of our 85+ microservices or just the ones you need to support your ISO rating and full policy administration needs. Customers can access Solartis microservices via API calls or through Solartis-rendered screens.

Solartis has redefined rating and policy administration systems with microservice technology. Carriers, insurance administrators, and their distribution partners are no longer constrained by monolithic technology platforms.

They can now replace costly components, extend, orchestrate, and collaborate with third-party providers to create unique API-centric technology platforms and customer ecosystems to simplify the process of purchasing and managing ISO commercial lines of business.

"They are fast, simple, and cost-effective. Their team is an extremely reasonable group of people who care, really care, about your success. Every launch has some bumps - they worked above and beyond to make sure those bumps didn't disrupt our launch or our ability to write new business. Without Solartis, I wouldn't be projecting a 30% increase in topline growth."

said Cameron Linder, CEO, Western Bowling Proprietors Insurance (WBPI), Rednil Insurance Brokers, Inc.

Select a Vendor that Provides all Three

By using the Solartis insurance microservices, its Solartis Builder, and the electronically-consumed ISO Content, Solartis customers can focus on what makes their offerings different and distinctive in the marketplace instead of worrying about maintenance and regulatory compliance of the underlying ISO commercial lines base products and the maintenance associated with their company filings. Solartis shortens time to market, reduces project risk, and provides customers with a microservice-based API platform that is nimble, extensible, and easy to use.

Solartis was founded with a mission to maximize the value of insurance. They do this by simplifying and automating the insurance policy lifecycle. Solartis customers are insurance carriers, managing general agencies, captives, and Insurtechs. Today Solartis has over 800 employees in multiple onshore and offshore locations. Every Solartis customer is a Solartis reference.

Data referenced in this article was sourced from ISO Support: A Comparison of Manual and Electronic Practices, A Novarica Research Partners Program Report underwritten by ISO.

Related Articles

The Secret to Success with ISO ERC™