- Our Microservice Technology

The Solartis Insure Platform

Supporting Capabilities and Tools

- Our BPO Services

- Resources

- About Us

- Contact Us

Search

- Our Microservice Technology

- Our BPO Services

- Resources

- About Us

- Contact Us

Search

Solartis Insure

Roll out insurance products faster and improve the customer experience with state-of-the-art insurance technology.

To succeed in today’s market, insurance companies must evolve their products and meet increasingly sophisticated customer needs. These businesses are turning to technological advancements to reshape their processes, rethink their offerings, and provide an exceptional customer experience.

Several technology trends are expected to have a seismic impact on commercial P&C insurance in the near future. These include:

Insurance companies can collect data from a wide range of sources that were previously unavailable, including IoT and wearables, smart phones, smart homes, and other devices - even online data and social media information can be used for data analytics. This generates valuable insights that are then used to optimize products, services, and brand.

“In addition to reengineering core processes, leading carriers and ecosystem players will use the advent of AI to create products and services based on data and analytics.” (1)

Using data analytics to provide accurate forecasting is set to change insurance as well, by using the data gathered from a variety of sources for ‘what-if” modeling. Insurers can apply future changes across their entire book of business, and measure the effects of different scenarios to improve decision-making.

Predictive analytics can be used by insurance businesses to:

Insurance Robotic process automation is the use of low-code, small scripts of code (also known as ‘bots’) that perform simple, repetitive tasks. The value of RPA is that it frees up human workers for higher-level, complex or strategic tasks. In fact, McKinsey estimates that RPA implementation provides 200% ROI within the first year. Another recent study found that successful RPA implementation can help insurance businesses free up 20-30% of capacity. At the same time, RPA significantly reduces human error, which improves the customer experience and reduces organizational risk.

In insurance, RPA can help businesses collect customer information, and auto-fill forms, provide automated follow-up alerts, and flag mismatches or data errors.

Insurance companies rely on a mix of legacy applications and systems. RPA can help link these disparate systems — with minimal coding — so insurers can conduct operations faster, reduce labor costs and explore new areas of business innovation. In fact, Gartner predicts that by 2025, 70% of new applications written by enterprises will use low-code or no-code technologies. [2]

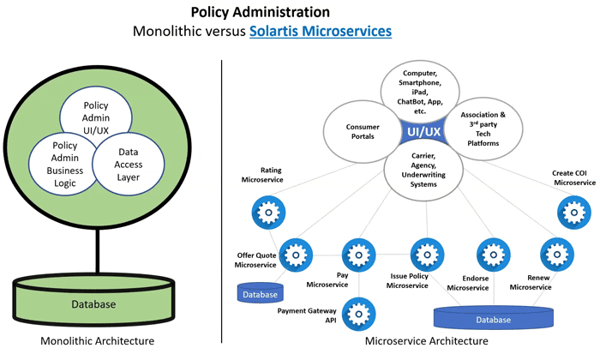

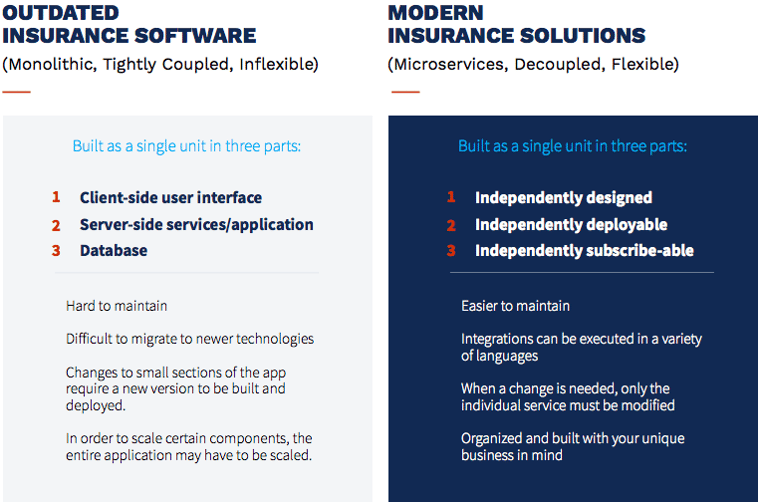

Many insurance businesses are bound by the limitations of large-scale, monolithic legacy applications. These are expensive and challenging to maintain, and nearly impossible to integrate with new technologies and applications. The future of insurance is not in building solutions on top of legacy apps, but instead, breaking them down into unbundled, disparate microservices.

[2]

Insurance technology that utilizes microservices helps established companies and insurtechs to:

In the highly-regulated insurance industry, one size does not fit all. Ever-changing regulations, integrating services and technologies and managing all the ongoing insurance product changes make technology investments very risky. Technology that requires customization is problematic, costly, and time-consuming. There is a better way to manage your insurance products - by using a fully-configurable platform.

A fully-configurable insurance platform allows you to rapidly configure all your insurance products and easily maintain them as they change over time. This is all done in a straightforward, non-disruptive environment that is can be mostly be supported by non-technical resources.

Here are just a few examples of what a fully-configurable policy administration platform can do for you.

The Solartis Insure fully-configurable microservice platform frees users from the constraints associated with legacy insurance policy administration software systems. It is a full suite of 100+ policy life cycle microservices that allows companies to replace expensive components while providing a unique, elevated customer experience.

Historically, launching niche insurance products from scratch has been problematic for companies as they have had to rely on monolithic software to manage the insurance policy lifecycle. Monolithic systems prevent established insurance companies and insurtechs from using agile methodologies, launching products to market quickly, and avoiding high overhead operating costs.

Future-forward core insurance systems like Solartis Insure utilize microservices to supports the entire quote and policy lifecycle. Using its microservices catalog, companies can choose from a range of specialized applications to find the best functionality for each feature, and ultimately build insurance products to fit any need.

The Solartis Project Management Toolkit (PMT) is used by Business Analysts to create and manage both Personal and Commercial P&C insurance products in the Solartis Platform.

Insurance technology that utilizes microservices helps established companies and insurtechs to: