As the resource gap in the P&C insurance industry continues to grow, companies are forced to explore alternative staffing options like business process outsourcing (BPO). Outsourcing your back office insurance needs allows carriers and insurance administrators to hit the ground running for new books of business that are not yet ready for automation or they are used on existing books of business to eliminate the processing challenges of their legacy systems (backlogs, duplicate entry needs, quality problems, resource retention issues, etc.).

Technology alone is not always the answer.

Instead, insurance companies need a knowledgeable, experienced partner to guide them to the best solution for their unique challenges: one that combines both human and technological resources.

"They are fast, simple, and cost-effective. Their team is an extremely reasonable group of people who care, really care, about your success. Every launch has some bumps - they worked above and beyond to make sure those bumps didn't disrupt our launch or our ability to write new business. Without Solartis, I wouldn't be projecting a 30% increase in topline growth."

said Cameron Linder, CEO, Western Bowling Proprietors Insurance (WBPI), Rednil Insurance Brokers, Inc.

Consider insurance BPO services when:

- You are tied to an outdated system, and administrative activities are impacting customer service, quality, or your ability to grow.

- The size of your book or program doesn’t yet justify the cost of a fully tech-based solution.

- You are transitioning to a new technology platform and need temporary operational assistance.

It’s estimated that there will be nearly 400,000 open positions in the insurance industry in 2020, but less than 5% of millennials are interested in working in insurance (1). Insurance companies face the challenge of finding qualified talent and reducing employee turnover in a complex and fluctuating business landscape.

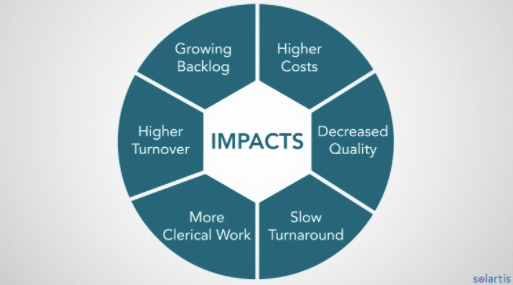

This lack of resources makes it difficult for insurance organizations to hire and train the high-quality employees they need quickly. As a result, internal operations and organizational productivity is affected, which leads to the following:

- Growing backlog

- The decline in the quality of policies and documents

- Longer turnaround time

- Increased clerical work

According to the U.S. Bureau of Labor Statistics, the number of insurance professionals aged 55 and older has increased 74% in the last ten years, leading the BLS to estimate that over the next 15 years, 50% of the current insurance workforce will retire, leaving more than 400,000 open positions unfilled. "

Business Process Outsourcing (BPO)

Flexible and robust outsourcing models are becoming more accepted as insurance companies leverage business process outsourcing (BPO) services. Business process outsourcing (BPO) is when insurance organizations contract specific business tasks to a third-party provider.

It’s an ideal solution for insurance carriers who are growing and can’t keep up with the workload, those that require flexible staffing options to accommodate work fluctuations or must compensate for staff turnover.

Third-party BPO providers

Partnering with a third-party BPO provider is a valuable and strategic option that can stimulate productivity and empower companies to continue growing despite demanding conditions. A third-party BPO provider gives your organization access to insurance-trained resources to deliver highly accurate administrative services that meet your organization’s high quality standards.

These outsourced employees can focus on various tasks, from general administration to data processing and mining. Insurance companies who leverage these services can experience the benefits of BPO, which include:

Benefits of Business Process Outsourcing

- Eliminate backlog.

- Reduce operating expenses.

- Relieve administrative burden.

- Focus internal teams on strategic outcomes.

Insurance BPO Provider

Consider outsourcing to a trusted insurance BPO provider, like Solartis Customer Delivery, to reduce the challenges managers face in hiring, training, turnover, and lack of available administrative resources.

Solartis Customer Delivery provides you with a team of high-quality insurance resources who act as an extension of your team. They are equipped to work with your technology and business processes and provide 99% clerical accuracy to meet your high-quality standards.

Companies who partner with Solartis for BPO can eliminate backlogs within days, allowing their team to focus on streamlining processes while improving quality.

Schedule a BPO consultation to speak with an insurance expert and learn how Solartis Customer Delivery can help grow your insurance organization with the help of business process outsourcing.

Sources:

- https://www.uschamber.com/workforce/education/the-america-works-report-industry-perspectives