A Practical Approach to BPO Viability Assessment

Insurance business process outsourcing (BPO) provides significant benefits for companies across the insurance industry - insurers, underwriters, MGAs, and brokers included. With BPO, these businesses can drastically improve turnaround times, efficiency, cost control, and customer satisfaction. But how do you know if BPO is right for your business?

With current unemployment rates at 1.6% for April ’231, the talent pool is slim, and people are starting to work longer hours to accomplish all the mundane tasks required to operate a successful insurance operation within various sectors.

The industry is retiring at an unsustainable rate, causing the workload to be spread over fewer and fewer people. A tight labor market is one of the reasons that insurance businesses are re-evaluating the ways that their processes are structured - looking for better staff and resource utilization without sacrificing quality or control.

If you are considering partnering with a BPO provider, your should first conduct a comprehensive audit of your non-revenue-centric tasks. Understanding exactly what is happening (and how much it costs) is the best way to determine how much BPO can help your business succeed. Get started with a task audit of excess and surplus lines of business!

Six Steps to Evaluate Your Insurance Office Tasks for BPO

Step 1: Current State

No matter the position, a workday is divided into two types of tasks: those that are directly tied to the bottom line (revenue-centric) and those that are not (non-revenue-centric.) It is important to track both types of tasks in order to get a comprehensive view of how employees are spending their time - and what it costs.

Classifying tasks on the basis of whether or not they can be directly tied to revenue gives you the starting point for assessment. Revenue-centric (RC) tasks can be assessed based on a cost-benefit analysis: how much they cost to complete, subtracted from how much revenue can be directly attributed to them.

Don’t forget non-revenue-centric (NRC) tasks though! They also indicate a cost to the business, and if that cost can be reduced with improved efficiency or productivity, it will directly impact the bottom line of the company.

Step 2: Efficiency / Productivity:

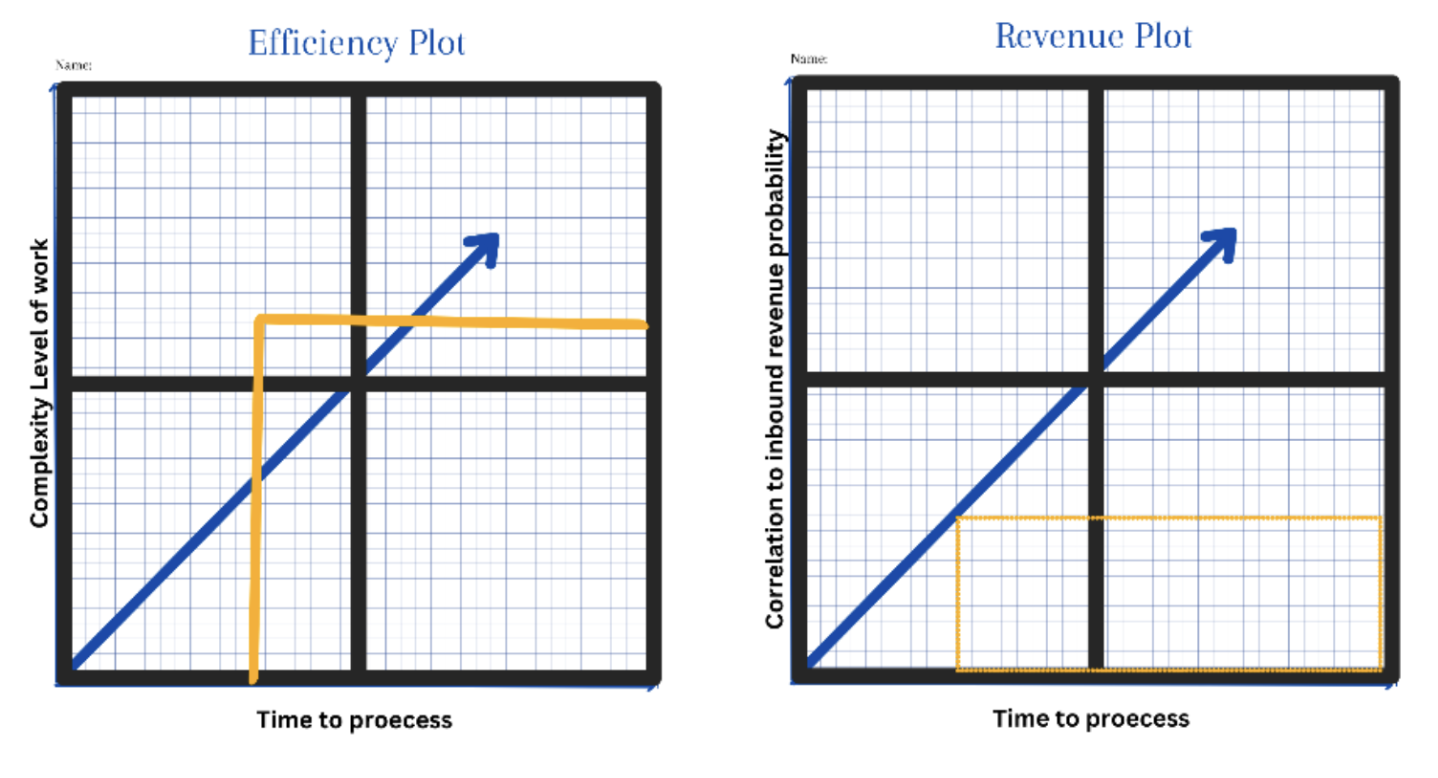

Once you have identified NRC tasks, it is time to look at key performance metrics, including turnaround times and error rates. Turnaround time will vary depending on the complexity of the task at hand as well as the error rate in processing. A high error rate will increase both resource utilization and turnaround time - because your business must invest in corrections, which takes time and effort.

Setting a benchmark for these KPIs will help your business identify bottlenecks, inconsistencies, or areas for improvement. You can gauge how much these tasks hinder your team’s ability to focus on revenue generation and growth-oriented activities. And where error rates are high (or increasing), you can determine whether the workflow needs attention or if new QA-focused protocols should be implemented.

This step helps insurance businesses identify those tasks that would be the highest priority to offload to a different team: either within your business or outsourced to a BPO partner.

One of the benefits of working with a consultative BPO partner is that assessments and evaluations are baked into their products. Solartis begins every engagement by analyzing the existing process of an individual task, then designing the optimal solution - so that you don’t just outsource a process, you improve it at the same time.

Learn more: Solartis Customer Delivery: Problems We Solve

Step 3: Cost and Optimization

Once you have identified the NRC tasks and calculated some key efficiency and productivity indicators, you can identify the areas where process optimization can have both immediate and long-term impact.

This includes specifying the resources that are devoted to NRC tasks. Don’t forget to include overhead expenses, including personnel, training, technology, software, and compliance, etc.

Consider the alignment of these costs with your budget and long-term growth plans. Identify potential optimization opportunities that could reduce costs without compromising the quality or compliance of your operations.

This provides a concrete number you can work from as you consider how to reallocate or outsource NRC tasks - and prioritize those that will have the highest impact on the bottom line.

Step 4: Scalability / Flexibility

Once you’ve identified high-impact opportunities for task reallocation, the next step is to decide where those tasks should go. Do you want to utilize the same team with improved processes, a different internal team, or an external team in an insurance BPO partnership?

Consider the outcomes of Steps 1-3: which tasks can have the greatest impact if they are optimized, and what is the capacity of internal teams to take these optimized tasks on?

An optimized process - streamlined and efficient - can boost productivity for internal teams, improving their availability for administrative tasks. But also, consider the possibility of taking your own team’s improved capacity and directing it toward the RC bucket of tasks, which can be tied directly to revenue.

Selecting a partner with expertise in insurance BPO may very well be the better option for your business. Outsourcing the NRC tasks to a trusted partner allows your team to focus on customer satisfaction, innovation, and revenue-centric strategies.

Step 5: Compliance / Risk Management

Review your compliance practices and risk management strategies for non-revenue-centric tasks. It is critical to evaluate whether your organization consistently meets industry regulations and best practices. Assess potential compliance risks and possible liabilities, such as penalties or legal consequences, or the impact that a failure to comply could have on your business's reputation.

Additionally, think about the ease with which your business meets compliance requirements. Is it difficult or time-consuming to gather the data and create reports for regulatory bodies?

Evaluating compliance history and challenges is a process that can inform the decision to outsource administrative tasks to a BPO partner. If your business regularly encounters difficulties in meeting regulatory requirements, there is an additional value to partnering with an insurance BPO company with compliance and risk mitigation expertise.

→ Explore Solartis BPO Reporting Solution: OptimX

Step 6: Customer Satisfaction

Finally, analyze the impact of NRC tasks on the customer experience. Delays, errors, or inefficiencies in the process can affect the overall quality of customer interactions. Does the time spent on NRC tasks compromise the customer journey? Streamlining NRC tasks can provide staff the capacity to focus more on customer satisfaction: while outsourcing NRC tasks can increase that capacity even more.

This assessment is extensive and requires effort on the part of business leaders. Gathering and analyzing data on task efficiency and performance isn’t likely to be on anyone’s list of hobbies! But there is a lot of value to be gained from putting the time into an assessment like this. With it, an insurance business leader can gain a deep understanding of the cost of operations, the value of streamlining, and the need to align efforts to long-term goals and objectives.

Discovering the Benefits of Solartis’ Customer Delivery:

Solartis offers a consultative insurance BPO service that is customized to help ensure that your business meets its goals and objectives. We begin with a task assessment and then customize a solution that makes the most of human expertise and cutting-edge technological solutions, blended seamlessly into a fast, effective, quality solution.

With streamlined processes, advanced automation, and automation/ai capabilities, Solartis BPO solutions enhance operational efficiency, optimize costs, ensure scalability, mitigate compliance risks, and improve customer experiences. Partnering with Solartis enables your team to focus on the most meaningful efforts for your organization's success.

"They are fast, simple, and cost-effective. Their team is an extremely reasonable group of people who care, really care, about your success. Every launch has some bumps - they worked above and beyond to make sure those bumps didn't disrupt our launch or our ability to write new business. Without Solartis, I wouldn't be projecting a 30% increase in topline growth."

said Cameron Linder, CEO, Western Bowling Proprietors Insurance (WBPI), Rednil Insurance Brokers, Inc.

Sources:

1. https://www.bls.gov/iag/tgs/iag524.htm

2. https://www.insurancejournal.com/magazines/mag-features/2023/02/20/708136.htm