Many organizations view the offshoring of administrative tasks and business processes as an indication of operational inefficiencies in the United States. Executives across industries have consistently reported over the last decade that they don’t anticipate a growing number of companies outsourcing clerical tasks offshore(1).

However, this strategy has seen growth in adoption rates year after year. When executed effectively, business process outsourcing can actually become an advantage over other organizations in your competitive landscape.

"They are fast, simple, and cost-effective. Their team is an extremely reasonable group of people who care, really care, about your success. Every launch has some bumps - they worked above and beyond to make sure those bumps didn't disrupt our launch or our ability to write new business. Without Solartis, I wouldn't be projecting a 30% increase in topline growth."

said Cameron Linder, CEO, Western Bowling Proprietors Insurance (WBPI), Rednil Insurance Brokers, Inc.

Insurance Business Process Outsourcing Background

Business process outsourcing has been used in various industries, including insurance, IT, financial services, and HR. The practice is used as a method for cutting costs and mitigating the exhaustion of internal resources in areas of your business that aren’t considered a first priority.

For example, an organization focused on expanding product offerings may need assistance with the administrative tasks of current product offerings. In this case, it would be smart to consider outsourcing some of the business processes of this existing book (i.e., policy issuance activities, issuing of certificates of insurance, generating loss runs, etc.) to a third-party BPO provider.

Insurance BPO Trends

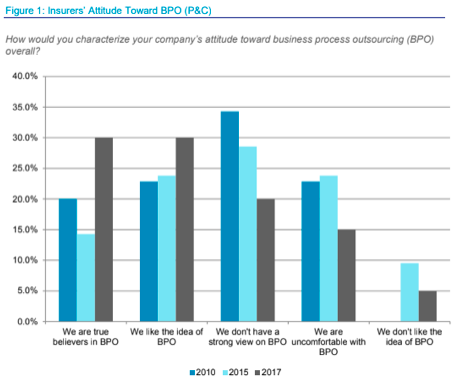

Over the last decade, insurers’ view of insurance BPO viability has shifted positively. Celent documents this trend in the graphic below.

In 2017, 30% of insurers that were surveyed considered themselves “true believers” in BPO(2). This is up 10% from seven years prior. Additionally, half as many insurers surveyed in 2017 communicated they flat out didn’t like the idea of business process outsourcing compared to just two years before. As is made clear by this Celent survey, sentiment is shifting. What about actual adoption?

The same report documents an increase in organizations who utilize BPO services extensively from just over 10% in 2010 to 20% in 2017, nearly doubling the number of companies that rely heavily on BPO as part of their business success. 0% of insurers communicated that they had never outsourced any business processes in 2017, down an average of 1% each year since 2017.

So what do all these numbers mean?

These reports suggest that even if your insurance organization is not outsourcing business processes, it’s likely that your competitors are. While they cut costs and streamline operations, your internal resources are continuing to be tied up.

One last statistic: nearly 60% of property and casualty insurers surveyed communicated that they plan to increase their use of BPO services in 2018(2). To stay competitive operationally, it’s important to evaluate what BPO (Business Process Outsourcing) can offer to your company’s long-term profitability.

Insurance BPO Experience

The most common benefit associated with outsourcing, regardless of industry or function, is cost-cutting. Interestingly enough, it isn’t the most desired outcome among insurers(2). The largest driver in BPO purchasing decisions is actually “getting access to best practice processes and tools,” with nearly 80% of respondents saying it’s a strong driver in 2017. Specialization has been a key component of economic prosperity since the Industrial Revolution, and some things never change!

Third-party BPO providers, like Solartis Administer, focus solely on the accurate execution of manual administrative and clerical tasks. Over time, these kinds of organizations develop internal procedures and systems that cannot be duplicated without extensive experience in the same line of work.

Considering insurance paperwork is their sole focus and these BPO providers aren’t concerned with insurance consumer demands or launching profitable insurance products in markets across the globe, they become extremely efficient - efficiency that non-specialized organizations will struggle to achieve.

Download our Solartis Administer Overview document to see a complete list of

services and how transaction-based pricing can save you time and money.

Third-Party BPO Providers

Avoid insurance paperwork overload, streamline your operations, cut costs, enhance focus, and get access to the best processes and procedures available in the industry by outsourcing clerical insurance tasks to a trusted third-party BPO provider like Solartis.

Want to speak with an expert and learn more about how BPO services with Solartis can help streamline your operations and cut down on costs? Schedule a BPO Consultation Today.

Sources:

- “Outsourcing and Off-Shoring Are Growing Trends.” KPMG, KPMG, 29 Jan. 2014, home.kpmg.com/xx/en/home/insights/2014/01/outsourcing-offshoring-growing-trends.html.

- “Business Process Outsourcing Services - US Market Research Report.” IBIS World, IBIS World, Apr. 2017, www.ibisworld.com/industry-trends/specialized-market-research-reports/advisory-financial-services/outsourced-office-functions/business-process-outsourcing-services.html.

- “Business Process Outsourcing Services - US Market Research Report.” IBIS World, IBIS World, Apr. 2017, www.ibisworld.com/industry-trends/specialized-market-research-reports/advisory-financial-services/outsourced-office-functions/business-process-outsourcing-services.html.

.png)